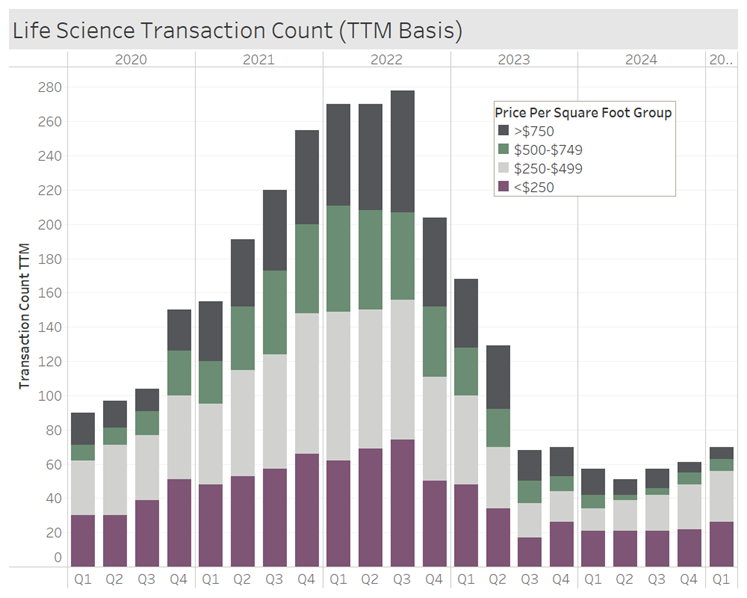

Revista recently released data for the 1st quarter of 2025. The preliminary transaction data shows 14 life science properties traded hands during the quarter. As per the chart, 70 properties traded over the last 12 months. On a positive note, the TTM number has been rising slowly over the past several quarters, but the count is still low. The average price per square foot is sitting at $424. Most of the properties that traded over the last twelve months were priced below $500 a square foot. Around 20% of the trades reached above that mark in the past year, compared to 45% during the pricing peak of 2022. Declining occupancy and sluggish acquisition activity have been pushing prices low, but 1Q25 numbers are showing signs of stabilization in occupancy rates. If occupancy rates can hold steady, then activity within the life science sector should pick up when economic conditions allow commercial real estate as a whole to get its wheels turning.