It is widely known that the wave of development in the Life Science real estate (LSRE) sector resulting from the Covid-19 pandemic response has impacted real estate fundamentals – particularly in the sector’s 3 largest markets. Digging into the data we can see the impact that development has had in these 3 markets – Boston, San Diego and San Francisco/San Jose.

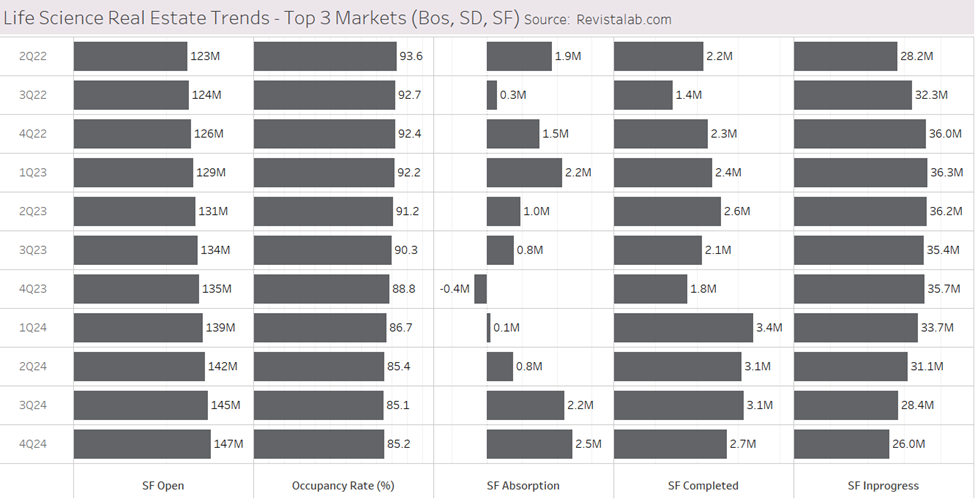

The chart below shows aggregate LSRE trends in the top 3 markets from 2Q22 to 4Q24. It represents almost 150 million square feet tracked by RevistaLab.com in these 3 markets. Overall, the occupancy rate has fallen during this period some 800 basis points (bps) from 93.6% in 2Q22 to 85.2% in 4Q24. Completions have been outpacing absorption during this period which has driven the occupancy rate down. Since 2Q22, in the top 3 markets, completions have totaled 27 million square feet compared to absorption of just 12.7 million square feet. With 26 million square feet remaining in the construction pipeline in these markets, expect occupancy pressures to continue into 2025.

But despite the occupancy challenges there are signs that fundamentals are stabilizing in these markets. Notice that absorption in these markets has risen each of the past 4 quarters. In addition, completions, while still outpacing absorption, have been slowing the past few quarters. The construction pipeline is also on a march down from higher levels several quarters ago. So while occupancy rates are not yet rising they do appear to be stabilizing at current levels.

Stay tuned to RevistaLab.com as we continue to revisit these trends in 2025.