Unprecedented levels of funding into biotech and pharmaceutical companies in recent years has created explosive growth in the sector. That growth eventually translates into the need for more space. Are we building to that growth? Revista has been working diligently over the past year to start answering questions like this by putting together the first complete database of Life Science properties and activity. We will be kicking off with the release of data for the top 3 clusters: Boston, San Francisco & San Diego.

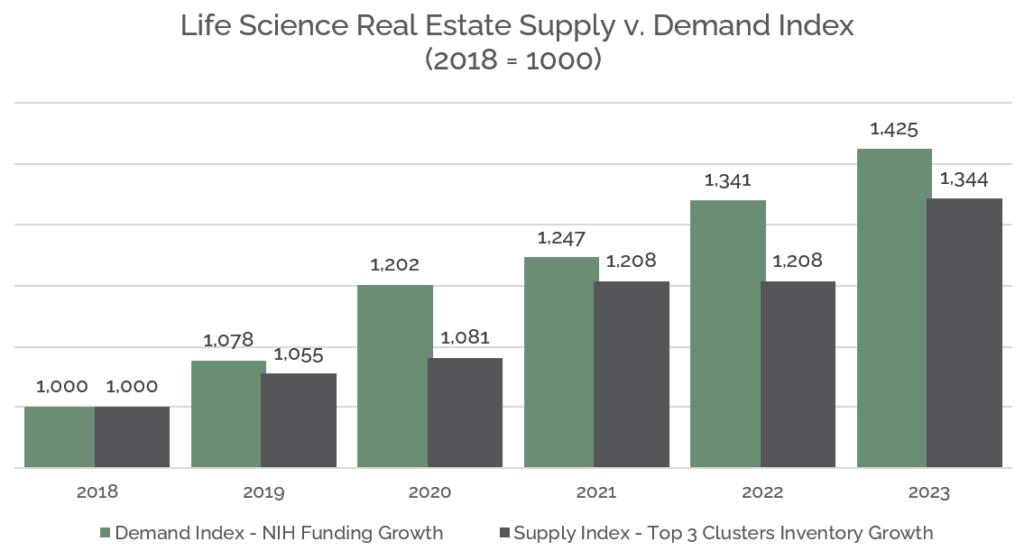

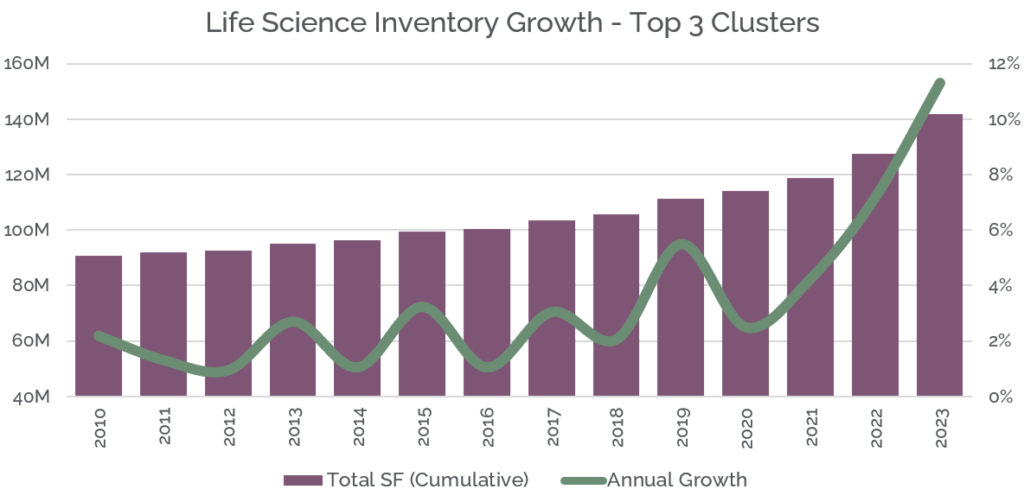

Construction in these key markets has certainly been on the rise – annual growth of existing inventory of life science buildings is expected to total 7.2% this year and 11.3% next year. This is after a long run of 2% average inventory growth. Despite coming down of late due to broader market conditions, funding in the sector has been, and is still, at all-time highs. Venture Capital funding into bioscience companies is still up 50% or more over pre-pandemic levels according to multiple sources. The National Institute of Health (NIH), although more insulated from market cycles, shows significant growth in the last few years, and the budget request for next year shows that continuing. On a percentage growth basis, we are nowhere near these numbers in terms of space. So is there an imbalance in the supply/demand equation? Join us at the Life Science Real Estate Investment Forum in Boston on October 13 and 14 to learn more!

Source and Copyright: NIH Funding Data www.nih.gov and Revista. Data believed to be accurate but not guaranteed and is subject to future revision. Use of this data is permitted subject to terms and conditions detailed on revistalab.com/terms-of-use and with proper credit to Revista or RevistaLab.com.

Source and Copyright: Revista. Data believed to be accurate but not guaranteed and is subject to future revision. Use of this data is permitted subject to terms and conditions detailed on revistalab.com/terms-of-use and with proper credit to Revista or RevistaLab.com.