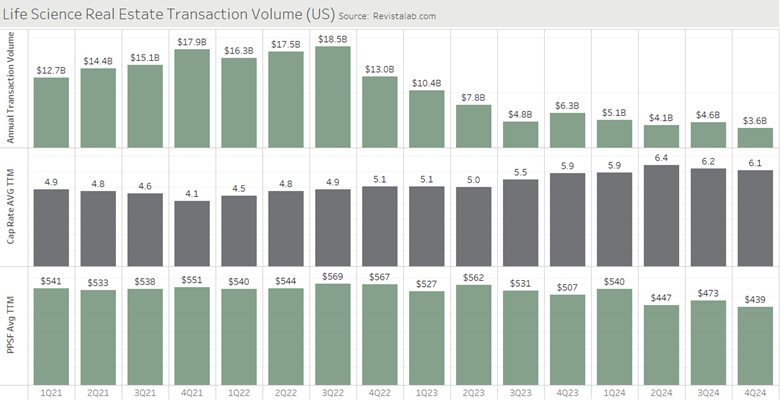

The Life Science Real Estate (LSRE) sector, like many other commercial real estate sectors, has seen transaction activity slow in recent years. Higher interest rates have created an uneasy investing and lending environment. The LSRE sector, which saw transaction activity establish a recent peak of $18.5 billion annually in 3Q22 has since slowed down to an annual rate of $3.6 billion. That’s a decline in annual volume of about 80% in a little over 2 years. During this time, cap rates have moved upwards. The average cap rate, which established a near-term low of 4.1% in 4Q21, has quickly moved upwards, registering a recent high of 6.4% in 2Q24. But while volumes are still lower, there are signs that cap rates are stabilizing, albeit at higher levels than we were seeing in 2021/2022. The average cap rate has come down by 30 basis points since 2Q24 and now sits at 6.1%. This stabilization could set the stage for a recovery in transaction volumes in 2025 or 2026. We will be here to monitor these metrics so stay tuned!