Preliminary data shows a total of $3.16 billion for life science sales in 2024, totaling 5.17 million square feet. This is equivalent to about half of the volume recorded in 2023. Yearly volume has maintained a consistent decline since 2022, and 2024 has yet to show a clear reversal. On a positive note, if we look on a quarterly basis, the second half of 2024 had significantly more volume than the first half. Over 80% of the volume in 2024 came from transactions in the second half of the year.

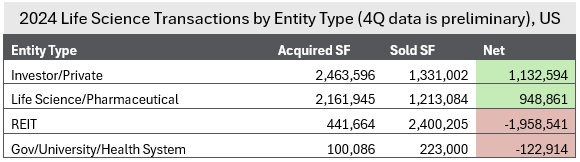

Despite the minimal number of transactions, we can still gain some insight based on how different players are navigating the market. In the chart below we have aggregated all the different buyers and sellers into four categories. We have then broken out the square footage that was acquired vs. sold. We can see that the Investor/Private and Life Science/Pharmaceutical companies acquired more than they sold, adding 1.1 million and .9 million square feet to their portfolios. REITs were the opposite, netting about a 2 million square feet sell off. As a group, REITs have been net sellers since 2021, where they acquired almost 6 million more square feet than they sold.

If you are interested in getting the individual transaction level data for performing your own analysis, make sure to contact us.

Life Science Real Estate Fundamentals Showing Signs of Stabilizing

Life Science Real Estate Fundamentals Showing Signs of Stabilizing