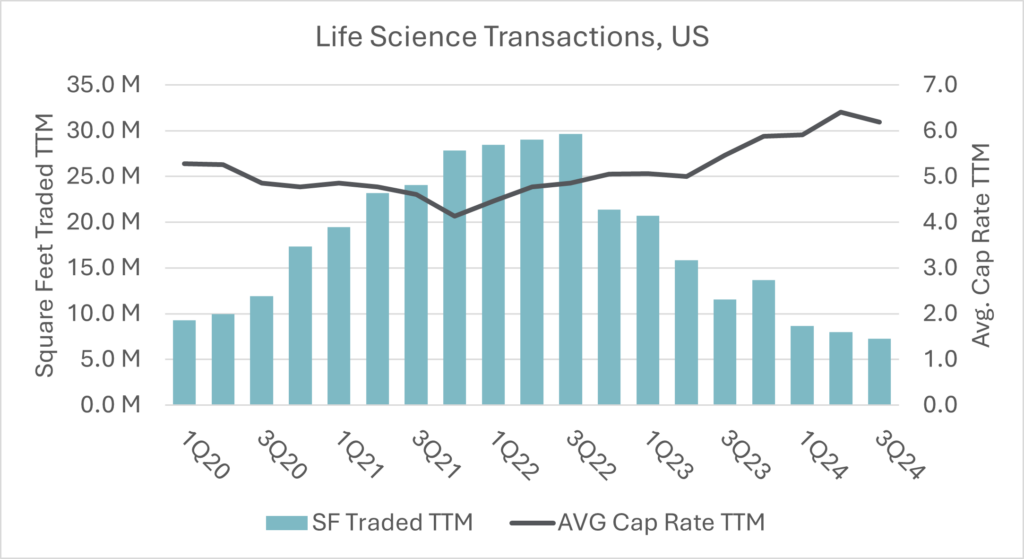

The first half of 2024 was slow going for life science property sales. About 1.5 million square feet traded hands, and the previous trend of declining activity continued. With rate cuts from this from this past September, are there any signs of a pivot? The chart below includes our preliminary data for 3Q and the trailing twelve-month square footage numbers show a slight decrease from the previous quarter (8 million vs 7.3 million). While the square feet numbers are showing a slight decrease, the volume in dollars shows a slight increase this quarter, with $4.5 billion over the past year. Cap Rates did decrease this quarter, coming down around 20 basis points to an average of 6.2. Overall, there is no significant change in activity, but that is expected, as the rate cuts only took effect in the last 2 weeks of the quarter. This primes 4Q as potential pivot point. With more potential rate cuts in November, as well as a presidential election, the next couple of months will be a busy period for the American economy, so make sure to keep tabs on the latest real estate trends.