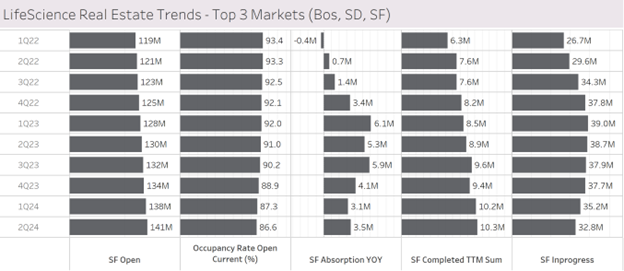

Over the past couple of years, life science real estate occupancy has been on the decline in the top markets. The top 3 markets represent over 1/3 of the US inventory and have the longest history as biotech clusters. Prior to 2022, there was generally a nice balance between the supply and demand for lab space in these markets. Life science inventory was growing in the 2-3% range and occupancy rates were in the mid to high 90’s. During 2022, inventory growth picked up to the 6-7% range and it is currently running at about 8% annually.

On the demand side, you can see absorption has been strong in these markets – there is still lots of leasing activity, but it is not enough to keep pace with supply growth. As a result, the overall occupancy rate has fallen from the mid 90s in years prior to 2022, to 86.6% in mid-2024.

Really the situation that has developed is a case of the haves and the have nots. Still over half of the properties in our database are 90% or better occupied, but the share of properties 10% or lower occupied has climbed to over 5% of all properties in 2024.