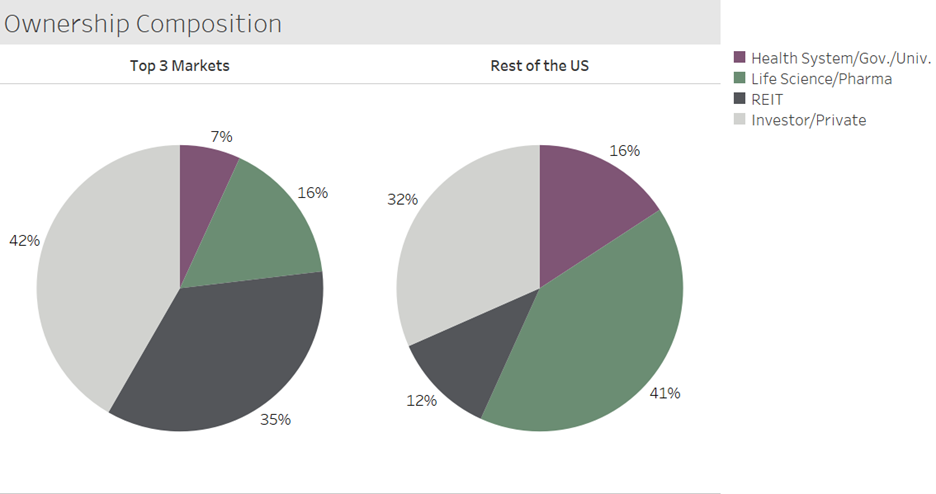

Life science real estate is clustered around the major markets. Boston, San Francisco, and San Diego are ahead of the curve when it comes fostering a life science ecosystem. It is interesting to compare these markets to the larger upcoming clusters, as well as the rest of the U.S. One aspect we can compare is the owner composition. The two pie charts below show the percent of the life science square footage that is owned by each category. The major difference between the top 3 markets and the rest of the U.S. is the investor presence. 77% of the top 3 markets are owned by either REITs or private investors. Compare this to only 44% for ownership of the rest of the U.S. It may come as no surprise that investors gravitate towards the well-established, high-rent areas. However, it will be interesting to see whether the upcoming clusters gradually increase in investor ownership as they develop.