Over the past few years, a spotlight has been on the Life Science industry (and the real estate that serves it) due to the pandemic and the rush to create an effective vaccine that could be produced in mass quantity in a record amount of time. The sector was already on the rise before 2020 due to accelerating advancements in biological research and technology. So who owns the current inventory of lab space, office, and manufacturing that supports this sector? Revista has been working diligently over the past year to start answering questions like this by putting together the first complete database of Life Science properties and activity. Our initial release of data will be for the top 3 clusters: Boston, San Francisco & San Diego.

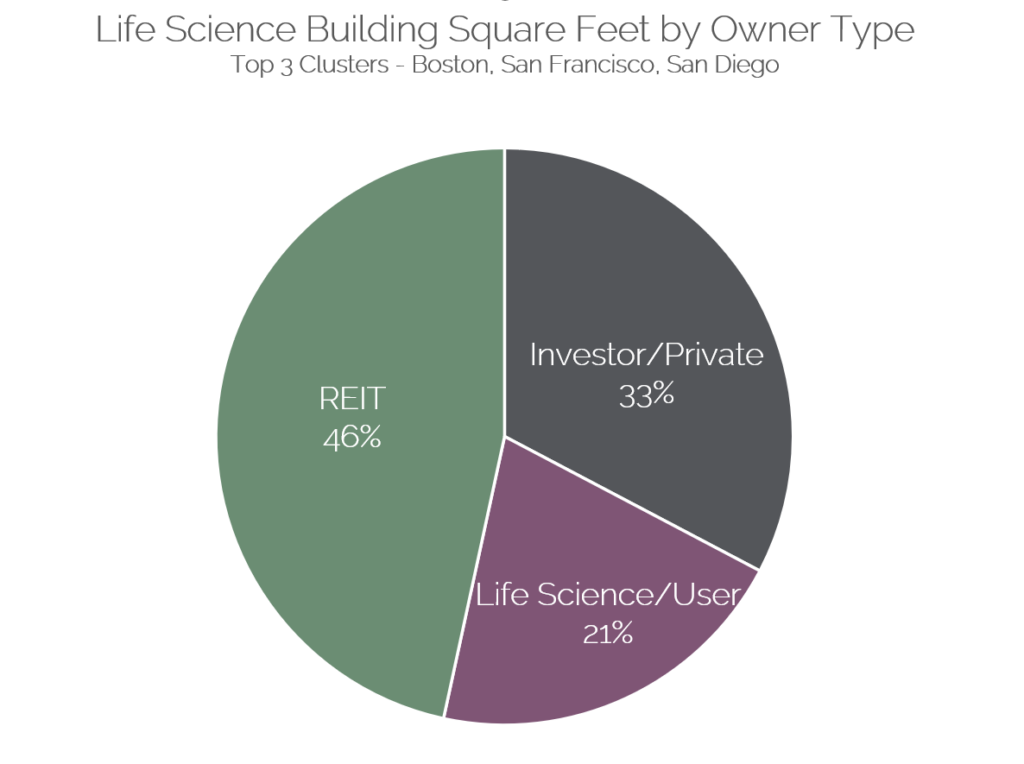

Across the top 3 markets only 21% of the existing inventory is owned by the user – whether that is a pharmaceutical or biotech company, university or other organization. The overwhelming share is owned by a third party – a private investor or REIT. This is indicative of a much different mentality than the healthcare sector where hospitals and health systems often prefer to own their key real estate assets, particularly on or close to their hospital campuses. With such a small segment owned by the user, sale-leaseback transactions are not the typical trade. Of course there are some, like this recent acquisition of a BioGen property by Boston Properties, but most of the sales activity is investor to investor.

The top ten owners of current existing inventory across these three markets are listed below. Alexandria leads, followed by BioMed and Healthpeak. Keep in mind this is just existing inventory – many investors are finding opportunities in developing new life science buildings in these top tier markets. Stay tuned for more on this and a list of the top developers coming soon!

Join us in Boston for the Life Science Real Estate Investment Forum on October 13th & 14th to learn more about Revista data, network with your peers and hear from industry experts about what they’re seeing in their markets.